Low-carbon energy has a growing presence in oil and gas industry deals and joint ventures, but it’s nowhere near a starring role, Ben writes.

Driving the news: Deloitte just released its latest report on global mergers and acquisitions. A few big themes…

- “Clean” energy — hydrogen, renewables, CO2 capture, biofuels, batteries and more — rose to a record $32 billion worth of M&A last year, accounting for 15% of total deal value.

- These sectors also accounted for 31% of joint ventures last year, up from 10% in 2018 and 7% in 2013, Deloitte found. They point out that JV partners can later become acquisitions too.

Of note: I know — I know! — that what’s really “clean” is a messy and debatable thing, but I’m not going there this morning.

Why it matters: The findings arrive amid the latest flare-ups over what role the industry will and should play in energy transition.

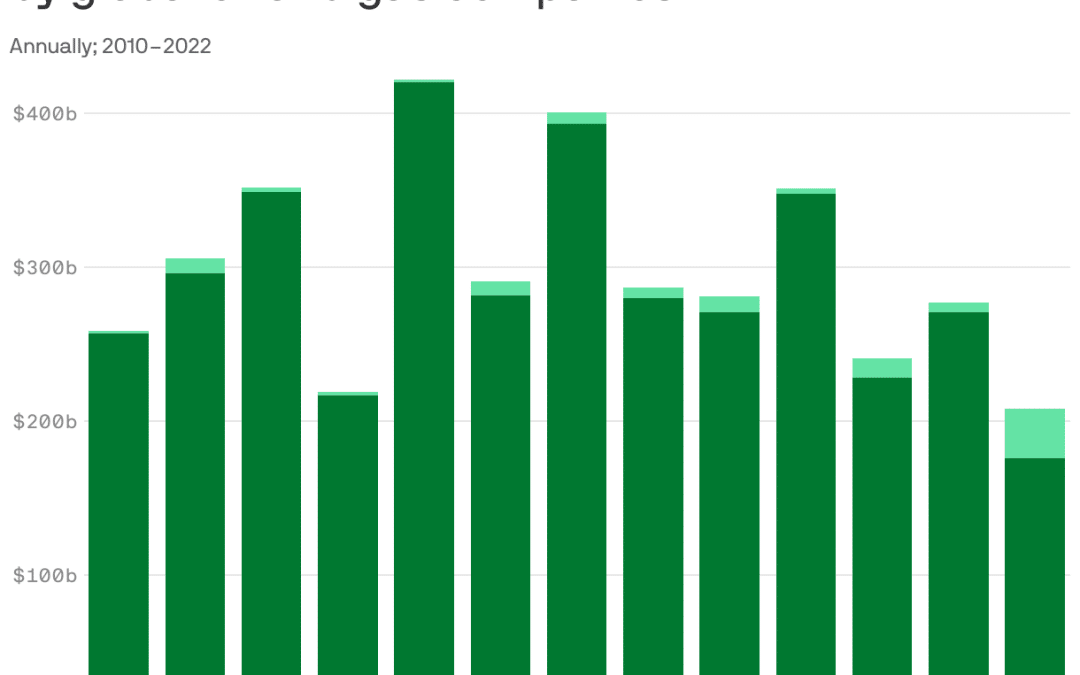

The big picture: Overall oil and gas M&A was at an 18-year low last year when measured as a proportion of industry size, even though companies have lots of cash.

- “From a peak of 10%, now less than 3% of the industry’s market capitalization gets exchanged,” Deloitte notes.

- Their analysis finds the traditional correlation between oil prices and deal activity has frayed “amid ongoing capital discipline and shareholder-focused strategy of O&G companies.”

The intrigue: Europe’s scramble for gas to replace Russian flows is also showing up in the deals market.

- Targeting gas and LNG assets had already become more popular since 2020 and spiked last year amid growing interest in energy security and U.S. exports.