The conventional wisdom since OPEC+ announced new production cuts is that the rate of U.S. production growth won’t change much despite the decision’s upward effect on prices, Ben writes.

What we’re watching: Whether the next projections from the Energy Department’s market analysis arm agree.

- The Energy Information Administration will release its latest outlook Tuesday.

- It’s their first monthly report since the surprise OPEC+ decision last week to jointly cut roughly 1.2 million barrels per day through 2023.

- And keep an eye on the International Energy Agency’s closely watched monthly oil market report coming Friday.

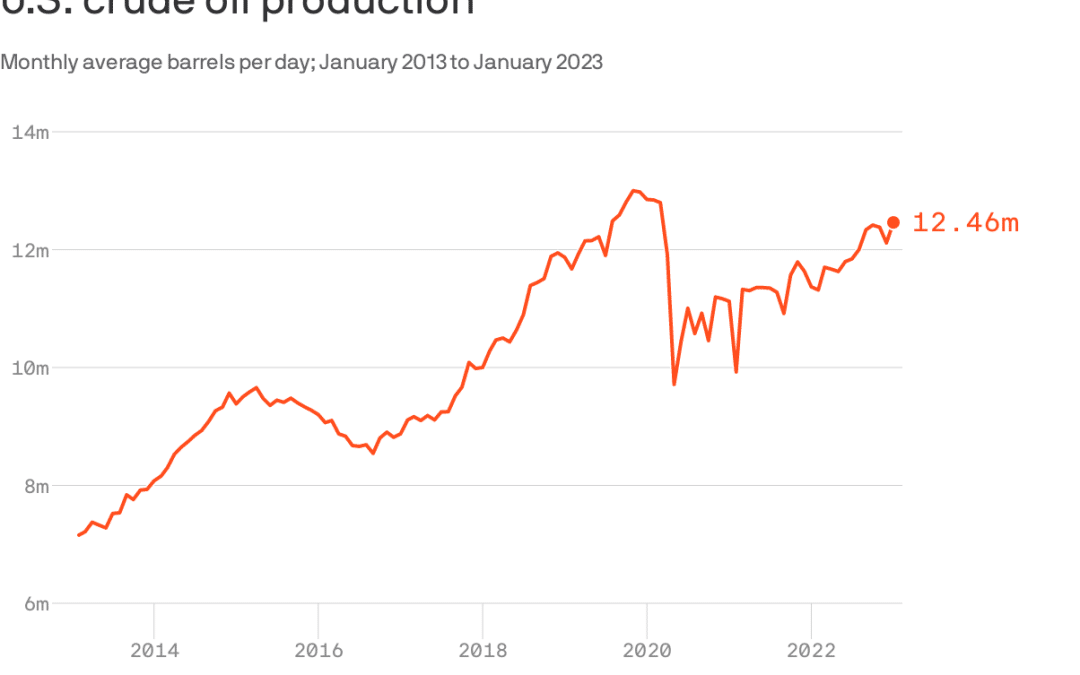

The big picture: U.S. crude production has been growing since the pandemic-fueled collapse, but still remains well below its pre-COVID peak.

- Capital discipline has been a big theme as producers and investors emphasize returns over volume. High input costs are also a check on production.

- The WSJ notes that the U.S. is just once source of added supplies but that some other nations have been growing faster in recent months.