Choose a Location

Residential Projects

Commercial Projects

SO MUCH MORE THAN SOLAR

Sol-Up is more than Las Vegas’s premier provider of solar and battery storage systems including solar panels, Tesla Powerwall, and solar installation of solar systems. Sol-Up also offers Tesla Energy Tesla Solar Inverters and Tesla Powerwall 2,Tesla Powerwall+ and coming soon the Tesla Powerwall 3.

We are a full-service energy solution and conservation company offering top-tier products since 2009. Engineering is our foundation, and we thoughtfully design each system with passion and purpose customizing your design with your high energy – power bill in mind, not an average power bill. We want to hit your usage with a knockout punch from the Nevada sun.

Our NABCEP Certified (the highest Solar Certification) Team provides honesty and integrity when designing your system with cutting edge solar technologies and competitive prices without compromise using our preferred Meyer Burger solar panels, SolarEdge, Tesla, and Enphase Inverter, Amana, HVAC or ProVia windows and doors. We have the proper solution for every household. Bundle up your solar system and save today!

THE SOL-UP SOLAR ADVANTAGE

Sol-Up employs the latest technologies to design and develop custom solar and storage designs by analyzing your home, power bill, consumption habits or expected changes, and trends.

Sol-Up uses advanced nearmap, satellite, and 3D imagery to provide-accurate estimates to ensure accuracy when understanding your post solar expectations are met.

Most competitors use sub-contractors for sales, permitting, and installation, but sol-up does this all in house with local employees from local high schools and colleges like UNLV

Zero Down – 25 Years

- $0 down On Approved Credit

- 25 year terms available

Bundle and save! Due to Sol-Up’s reputation, we have lenders for almost every credit profile and situation. Sol-Up, Solar Panels Las Vegas is a full-service provider of energy efficient windows and doors, solar-plus-battery, smart panels, and HVAC.

Sol-Up University

Sol-Up, Solar Panels Las Vegas has its own Solar University at its Dean Martin Campus. Here, our Installation Teams undergo rigorous training on all roof types and complex electrical hookups with a focus on safety, quality, and esthetics. We invite you to visit our showroom and Sol-Up University to see for yourself.

Why Sol-Up

Sol-Up, Solar Panels Las Vegas engineers and installs the highest quality energy products available in today’s ever-changing markets. Industry giants such as Meyer Burger, Tesla, SPAN and ProVia have forged strategic partnerships with Sol-Up. These partnerships are not by chance but have been carefully curated through our deliberate approach to aligning ourselves with like-minded and engineering focused partners.

Zero Fuel Bill

Imagine charging your car with your solar system or battery and never purchasing gasoline again! How much do you spend per month in fossil fuels? Sol-Up, Solar Panels Las Vegas has reduced the environmental footprint with state-of-the-art Electronic Vehicle (EV) Charging Stations.

YOUR TRUST IS IMPORTANT TO US

Days of NV Sunshine

Installed in Nevada

Homes Installed

ACHIEVE ENERGY INDEPENDENCE WITH SOL-UP

What’s on your rooftop?

While most solar companies sell low priced solar modules (photovoltaic cells and modules), Sol- Up is committed to providing the latest solar panel technology, known as heterojunction (HJT). HJT is the highest performing, state of the art solar technology available.

See More...

As an engineering organization, Sol-Up only selects products that are designed and certified for the extreme weather conditions of the Western United States. Your home is your largest investment, and our products enhance efficiency, decrease energy dependence, and add value.

Sol-Up manages all aspects of your project, from your HOA to Nevada Energy interconnection, while helping create your path to energy independence.

Learn more about our solar panel installations and solar panel cost by getting your free quote today.

Span Smart Panels

The electrical panel is an essential part of your home, interfacing with the grid, solar, battery storage, and everything you power.

Get the panel that helps you achieve your energy upgrade goals while giving you better options for managing your battery backup.

See More...

Span is making home energy connected and intuitive with a smart electrical panel that makes it easier to adopt clean energy and optimize power. Span Smart Panel design is so modern and beautiful, you can even install it in your living room and control your power from the palm of your hand.

Black-out Free with a Tesla

Sol-Up is Nevada’s largest Tesla Powerwall Certified Installer! Meaning we can offer you and your family or business a customized solar-plus-battery solution that enables you to take full advantage of the abundant power of the Nevada sun while reducing your reliance on fossil…

See More...

…fuels. Imagine being “black-out” free.

Sol-Up’s in-house engineers will design a system to meet your backup requirements to prevent costly loss of perishables and a compromise to safety. Do you want to back up your refrigerator, alarm system, and HVAC or your wine storage and medical devices?

We have solutions for almost every situation large or small. Install a Span Smart Panel with your battery and have

complete control over which loads you want to back-up on the fly. We also install Electric Vehicle (EV) Charging Stations, giving you the best of the best.

DISCOVER MORE

ProVia Endure Windows & Doors

ProVia Windows & Doors ProVia doors and windows are manufactured to the highest standards of durability, energy efficiency, and security. All our doors and windows offer exceptional performance, energy savings, options for customization, and lifetime warranties.

Replacing old doors and windows with ProVia products provides long-term return on investment and increased security, endurance, and thermal efficiency.

See More...

ProVia’s entry doors—Signet, Embarq and Heritage Fiberglass and Legacy Steel—are produced with premium materials and expert craftmanship, resulting in a strong, sturdy, dependable door with a beautiful woodgrain or painted finish. Our patio and storm doors provide attractive, low-maintenance, protective entryways that allow light and fresh air into the home.

Endure, Aeris, Aspect and ecoLite window lines offer functionality, energy efficiency and beauty. Our custom windows ensure a wide variety of looks, with numerous styles and decorative options for finish, glass and grids, all while providing incredible energy efficiency.

ProVia has partnered with ENERGY STAR® since 2002 to ensure that we produce energy-efficient, professional-class windows and doors that meet or exceed their certified criteria. ENERGY STAR windows and doors have been independently tested and certified to meet strict energy-efficiency standards set by the Environmental Protection Agency. Our engineers have worked closely with the voluntary ENERGY STAR program to design and produce entry doors and replacement windows that provide energy savings and value to our customers.

We are proud to have been recognized over the years for our efforts. In 2022, we received our 15th Energy Star Partner of the Year Sustained Excellence Award from the US Environmental Protection Agency and the Department of Energy. Products that meet these criteria have the distinctive blue ENERGY STAR logo as part of their packaging or marketing materials.

Hurry! I can’t wait!

Sol-Up is a Tesla Powerwall Certified Installer, which means we offer you and your family or business a customized solar-plus-battery solution that enables you to save money and access the free, abundant power of the sun, reducing your reliance on fossil fuels. You are protected in the case of a power outage and the grid going down, keeping your wi-fi going and your refrigerator running. We also install Electric Vehicle (EV) Charging Stations, giving you the best of the best.

‘Green’ Multi-Purpose Cleaner

Sol-Up’s Multi-Purpose Cleaner is plant-based, chemical-free, and bio-enzymatic. We employ and utilize earth-friendly science to kill bacteria, clean and degrade dirt and food residue, cut grease, eliminate odors, and remove light stains

on carpet and fabrics.

Our product utilizes beneficial enzymes to clean surfaces with a combination of good, safe,natural bacteria along with specifically…

See More...

…selected enzymes to work together to digest wastes, oils,

soils, starches, and stains. This microscopic reaction is safe for YOU, your PETS, and the

ENVIRONMENT!

Sol-Up searched for a simple non-toxic multi-purpose cleaning solution for its solar panels, that was human and pet friendly, odor-free, bleach and chemical-free. Unable to find such a product we partnered with our friends at Clara-Vita to design just that.

What started as a quest to have healthy air and surfaces for our co-workers and clients has grown into a product that not only cleans solar panel surfaces, kitchen, bath, residential and commercial, but also contributes to the well-being and overall health of everyone who uses it.

Today, our partnership is using their collective breakthrough eco-friendly ideas and pioneering the use of plant enzymes to do the dirty work the natural way, not the way harmful chemicals do.

Our Partners

Meyer Burger Pinnacle Partners. Sol-Up is the only U.S. Pinnacle Partner of Meyer Burger.

SolarEdge Each solar module (also called solar panel) on your roof is connected to a SolarEdge Power Optimizer which transforms it into a smart module. Working together with our high efficiency inverters, they harvest the maximum amount of energy possible, regardless of shading, soiling, and other factors to provide your home with more electricity over the system’s lifetime.

Tesla Powerwall is undeniably the leader in battery technology. Powerwall and solar provides your true energy independence and locks in your costs for a lifetime.

Pearl Certification Pearl is a nationwide company who only works with 5% of all contractors in this country. There are only two companies in Nevada offering this.

Span Smart Panels is the smart and beautiful solution to a home electrical panel allowing access and full control of your electrical needs from the convenience of your smart phone.

WallBox EV Charger is a global company, dedicated to changing the way the world uses energy in the electric vehicle industry. Wallbox creates smart charging systems that combine innovative technology with outstanding design and manage the communication between vehicle, grid, building and charger.

ProVia Windows & Doors have received the Energy Star Partner of the Year Sustained Excellence Award for the last 13 years from the U.S. Environmental Protection Agency and the Department of Energy. ProVia is the only energy efficient windows and doors company to achieve such honor.

Our CUSTOMERS LOVE US

Our Blogs

In the news

DID YOU KNOW?

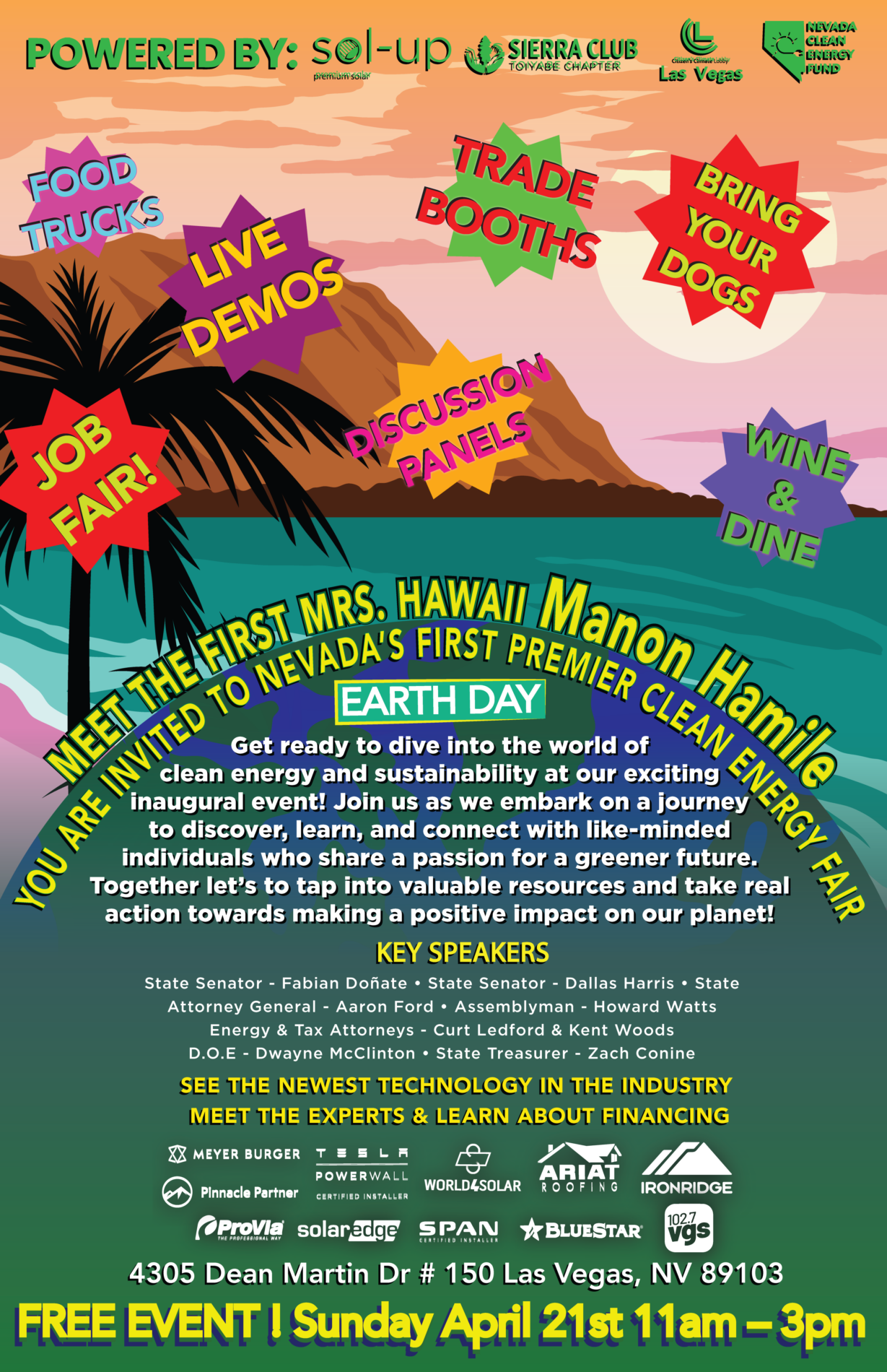

IN THE COMMUNITY

Follow US

Problem displaying Facebook posts. Backup cache in use.

Click to show error

Service Areas

Green Valley Ranch, MacDonald Ranch, Anthem, Westgate, Green Valley South, Enterprise, Summerlin, Spring Valley, Green Valley North, McCullough Hills, Sovana, Lake Las Vegas, Henderson, Paradise Hills, Calico Ridge, The Lakes, Peccole Ranch, Paradise, Gibson Springs, Canyon Gate, Black Mountain, Winchester, Boulder City, Whitney Ranch, Las Vegas, North Las Vegas, Henderson, Summerlin South, Paradise, Spring Valley, Sunrise Manor, Enterprise, Winchester, Whitney, Blue Diamond, Cactus Springs, Enterprise, Indian Springs, Mount Charleston, Paradise, Spring Valley, Summerlin South, Sunrise Manor, Coyote Springs, Mountains Edge, Pinnacle Peaks, Quarry Highlands, Sunrise Highlands, Rhodes Ranch, Southern Highlands, Summerlin South,

Only solar showroom in Las vegas

Are you looking for an environmentally-friendly, affordable means to power your home? If you’re searching for a cost-saving solar energy system, look no further than Sol-Up solar. With such volatile energy prices, solar energy is an ideal option for those looking to reduce spending.

Sol-Up is Nevada’s top and best solar installer, providing residents and businesses with high-quality, cost-effective solar energy solutions. Sol-Up has the expertise and resources to ensure that your solar project is completed quickly, safely, and efficiently. They use only the highest quality materials and have an experienced team of professionals who specialize in a variety of solar services, from solar panel installation and maintenance to system design and financing. Sol-Up is committed to providing the best customer service and making sure that each project is completed with the highest level of quality and craftsmanship. With a commitment to excellence, Sol-Up is the go-to solar installer in Nevada.

SPAN SMART PANELS

Span is making home energy connected and intuitive with a smart electrical panel that makes it easier to adopt clean energy and optimize power.

TESLA POWERWALL INSTALLATION

Sol-Up is a Tesla Powerwall Certified Installer, which means we offer you and your family or business a customized solar-plus-battery solution that enables you to save money and access the free, abundant power of the sun and reduces your reliance on fossil fuels.

MAKE THIS WORLD MORE SUSTAINABLE, ONE REFERRAL AT A TIME

Sol-Up is proud to say that over 30% of our business is through referrals, giving testament to our focus on our core values of quality and service. Start earning money today! Your friends and family will thank you and we thank you for your continued loyalty.